2023 Finance Report: Profitable, More Assets than Liabilities, Over $9m in Sales, 50% Margin

Todd Weaver

PGP Fingerprint: B8CA ACEA D949 30F1 23C4 642C 23CF 2E3D 2545 14F7

Latest posts by Todd Weaver (see all)

- Closing the App Gap; Focus and Momentum - September 9, 2025

- Hardware Encrypted COMSEC Bundle by Purism - April 29, 2024

- Purism Differentiator Series, Part 14: Surveillance Capitalism - April 23, 2024

Video Read-through of 2023 Year End Financial Update:

Slides and Transcript

Welcome to Purism’s Investor Report Fiscal Year End 2023.

In this report we’re going to go through an executive summary, profit and loss statement, balance sheet, and then conclusion.

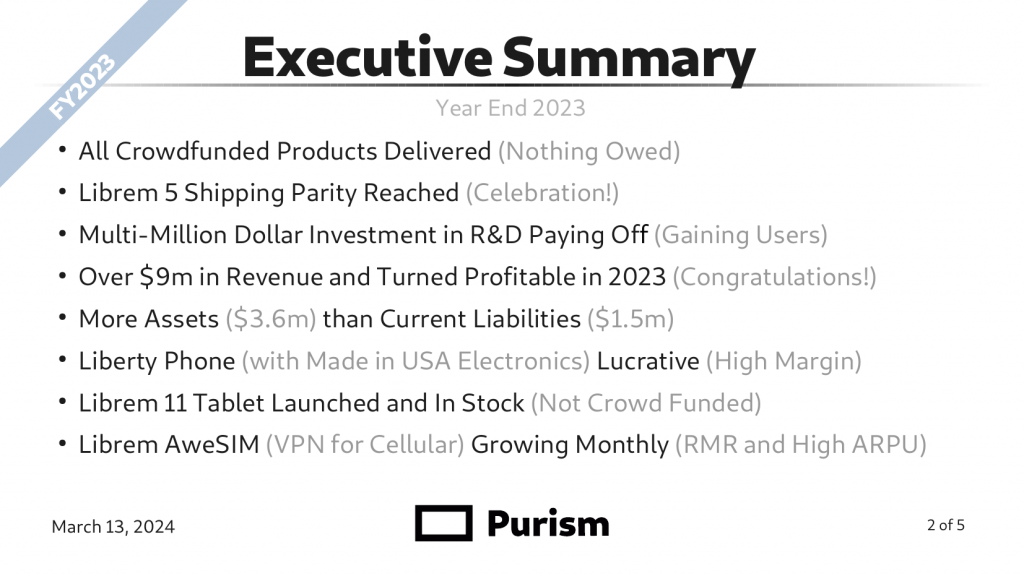

Executive Summary:

All crowdfunded products have been delivered. This is important because the Librem 5 phone was crowdfunded and we crossed shipping parity where all of the phones have been delivered to all customers.

Our multimillion dollar investment in R&D is paying off, overall more sales and gaining users.

We had over $9m in revenue and turned profitable in 2023. We have more assets, about $5.5m, than current liabilities about 1.5m. (asset to liability ratio of positive $3.6m)

The Liberty phone with made in USA Electronics is quite lucrative with very high margin.

The Librem 11 tablet launched and is in stock. We invested our own dollars to bring that product to market.

Librem AweSIM, what we call VPN for cellular, is growing monthly, it’s a nice recurring monthly revenue model with high ARPU.

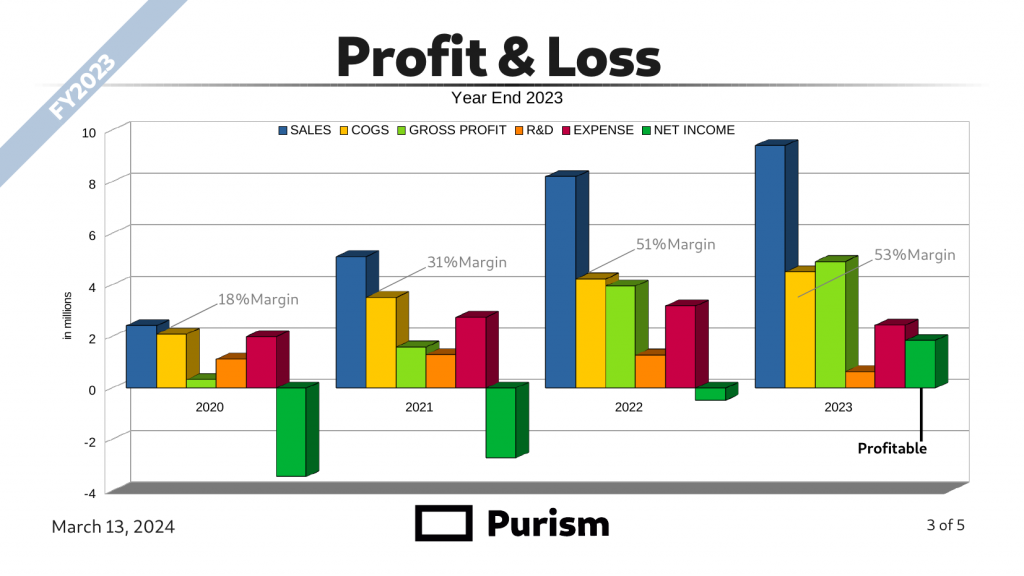

Profit and Loss:

Purism profit and loss chart is grouped in the last four years and the categories are blue: sales, yellow: COGS, light green: gross profit, orange: we broke out R&D, red: expense, dark green: net income.

2020: a little over $2m in sales, 18% margin, small gross profit, high R&D, high expense, because we were developing the products we offer today.

2021: over $5m in sales, 31% margin, higher gross profit, we did invest more in R&D and expense to build out the products we offer today.

2022: over $8m in sales, 51% margin, much higher gross profit, about the same R&D spend as the previous year, expenses went up slightly, overall just under break-even.

2023: over $9m in sales, 53% margin, much healthier gross profit, we lowered R&D and expense and focused on delivering the existing products that we had, therefore yielding a profitable year.

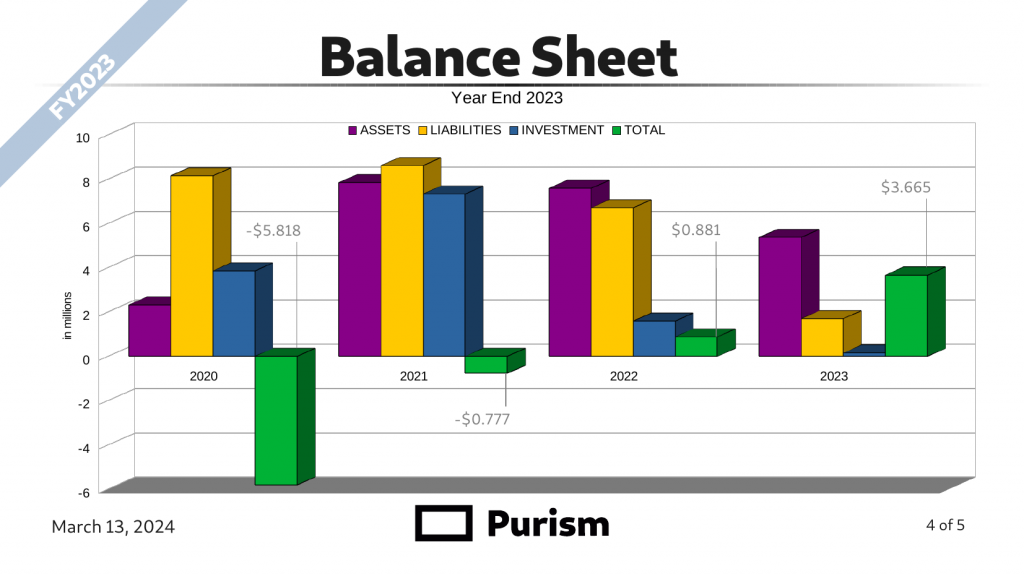

Balance Sheet:

Purism balance sheet chart, purple: assets, yellow: liabilities, blue: investment added, green: total asset to liability ratio.

2020: we had about $2m in assets, and over $8m in liability, adding investment so we could continue to focus on R&D and product delivery.

2021: our assets grew to about $7.5m, liabilities creeped up to little over $8m, and we added significant investment so that we could focus on R&D and well as delivery.

2022: we flipped the script to assets greater than liabilities, a small amount of investment added, which brought us to a net positive total asset to liability ratio.

2023: we were able to reach shipping parity, clearing an awful lot of our liability and therefore increasing our total asset to liability ratio.

Conclusion:

In a brief conclusion, Purism went from a high risk, crowdfunded backed, therefore large liability, to profitable stable business.

We’ve added new products by self funding that growth.

Total revenue has grown year over year.

We’ve improved margin to above 50% company wide.

We have new products that are on the horizon (capital determining).

We also launched our equity investment on StartEngine in January 2024.

I’m proud to share this amazing accomplishment with you.