The Ball and Supply Chain

Todd Weaver

PGP Fingerprint: B8CA ACEA D949 30F1 23C4 642C 23CF 2E3D 2545 14F7

Latest posts by Todd Weaver (see all)

- Closing the App Gap; Focus and Momentum - September 9, 2025

- Hardware Encrypted COMSEC Bundle by Purism - April 29, 2024

- Purism Differentiator Series, Part 14: Surveillance Capitalism - April 23, 2024

This is part 1 published 2021-04-30. Part 2 published 2022-07-25.

Every manufacturer has a supply chain, down to the raw materials suppliers whose supply chain is the earth itself. Links within the supply chain can (with difficulty) be swapped out for similar suppliers but each link in the chain and who controls that link is important. Over the course of the last twenty years the method of holding swaths of inventory (which is equivalent to cash value sitting on shelves) began dwindling in favor of just-in-time manufacturing, and the more reliable the suppliers in a supply chain on delivering just-in-time the less desire to hold inventory (also called safety stock).

Manufacturing in the technology sector has some additional churn to dissuade holding parts stock in high quantities, parts like an I.MX8M Quad rev AA, are devalued when they’re deprecated in favor of the improvements created by rev AB. This high-churn in technology reinforces the just-in-time nature of manufacturing and acts like a heavy, metal ball on that chain that restricts your movement.

The Ball

Just-in-time works really well when it works really well. But the ripple effect of a global pandemic upon every sector of the globe, coupled with more demand for devices that are full computers in IOT and Automotive, causes a lot of companies to feel the immobilizing weight of the ball attached to the supply chain.

The Chain

Another trend over the past twenty or so years is the reliance upon outsourcing. Similar to the materials supply chain, more and more companies have shifted entirely to sales, marketing, and finance as their primary labor, and most in the tech sector also add development, usually in the form of software development (with mostly digital goods produced, no tangible goods). This trend adds more links in the chain, and the more links, the less control of those links when there is a problem.

The Problem

Parts, price, and lead-time. Parts are getting harder and harder to find, and using alternatives require engineering talent that most companies don’t have (we do), so these parts shortages mean procurement scrambling, similar to the toilet paper frenzy early in 2020 as the pandemic reached regional shelter-in-place levels. But unlike that TP shortage that was short lived, this frenzy repeats weekly. Parts get snatched up, and some may even return again at a higher price.

Price is one of the biggest factors in supply and demand. Parts brokers are able to seize on this opportunity for some parts and therefore charge $35 for a part that has consistently cost $5 for a decade. Even at the resistor level parts can be unavailable requiring procurement of tighter tolerance resistors at a higher price.

Lead-time is another big problem. Parts like more complicated integrated-circuits (ICs) are sometimes irreplaceable for a product. The lead-time from the parts maker needs to be factored in, these lead-times are increasing every week, with the theoretical end of increasing lead-times being sometime in 2022, when just-in-time will probably work really well again. Some parts will be available within months, while others may not see full restoration to pre-pandemic levels of availability until after 2022.

The Solution

Pay, price, and persevere. It will be challenging to be able to produce product in the coming quarters, and paying the premium to have parts is one part of the solution.

Prices will increase as consumer goods (the end product) become more scarce and the bill-of-materials (BOM) are bought for higher and higher prices. This passing on of the price increases allows for the market to determine what products are worth the higher prices, and commodity priced products are likely to suffer the most. We will be increasing prices in stages over the next year as BOM prices change and as we deliver greater quantities of product.

Perseverance is the best solution for longevity. Having a dedicated team who address problems by finding answers rather than giving up ensures that product will be delivered, sometimes at a higher price, and sometimes a bit later than hoped, but delivered nonetheless.

Products and Availability

At Purism we have a growing list of products, Librem Servers with PureBoot, Librem Key USB security token, Librem 14 laptop, Librem Mini, and two separate supply chains for Librem 5 phone and our Librem 5 USA with Made in USA Electronics.

The below chart will help share the top-level supply, availability, and impact.

Purism Products and Availability Chart

| Model | Status | Lead Time | ||

|---|---|---|---|---|

| Librem Key (Made in USA) | In Stock ($59+) | 10 business days | |

| Liberty Phone (Made in USA Electronics) | In Stock ($1,999+) 4GB/128GB | 10 business days | |

| Librem 5 | In Stock ($799+) 3GB/32GB | 10 business days | |

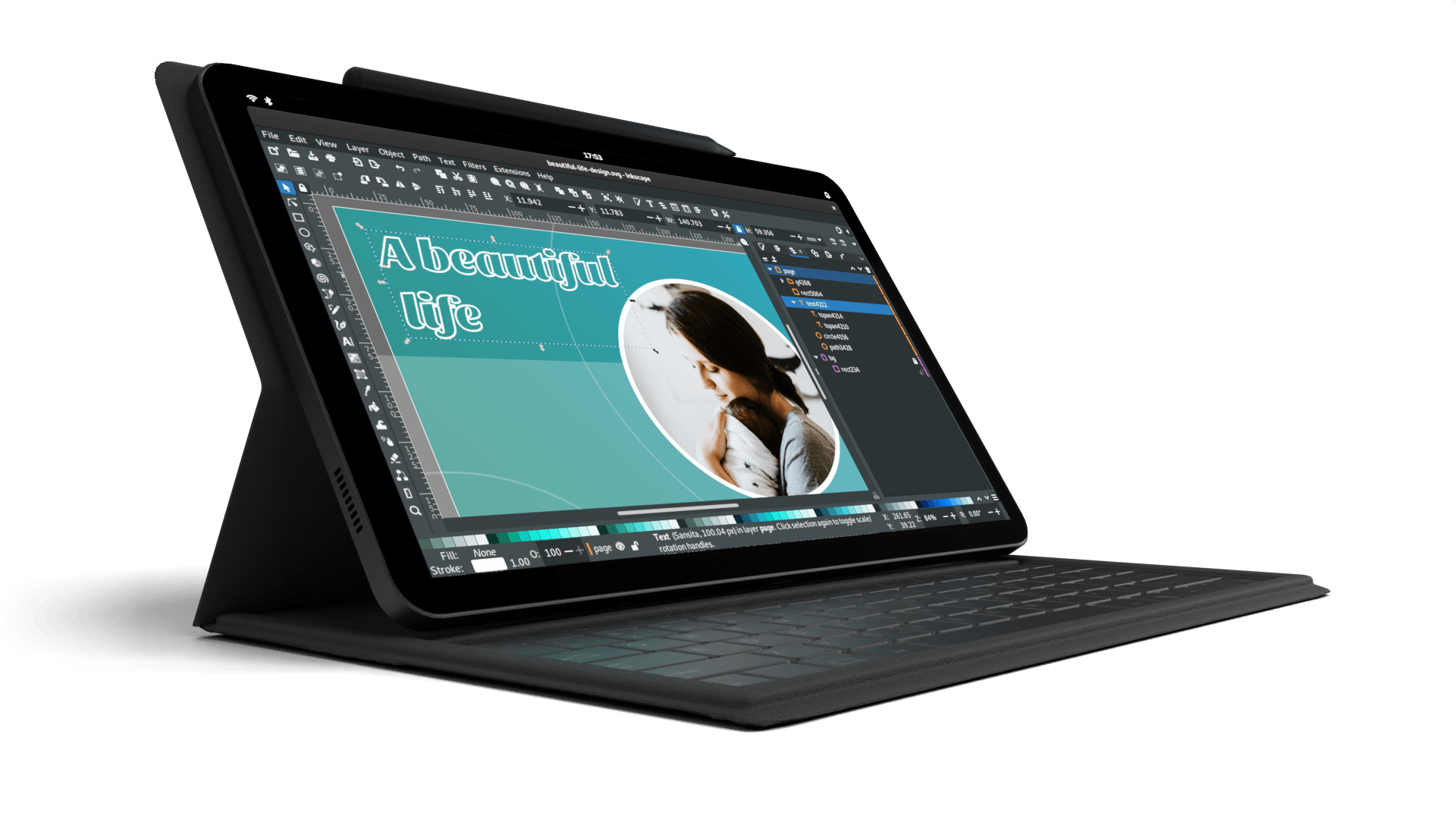

| Librem 11 | In Stock ($999+) 8GB/1TB | 6+ weeks | |

| Librem 14 | Out of stock | New Version in Development | |

| Librem Mini | Out of stock | New Version in Development | |

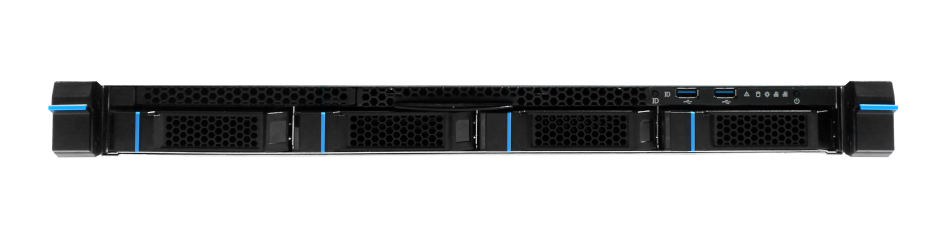

| Librem Server | In Stock ($2,999+) | 45 business days | |

| Librem PQC Encryptor | Available Now, contact sales@puri.sm | 90 business days | |

| Librem PQC Comms Server | Available Now, contact sales@puri.sm | 90 business days |

The Future

One of the exciting things about building a company that has tighter control of the supply chain with engineering expertise to handle issues, and even doing US manufacturing for our Librem 5 USA with a US-based secure supply chain, is that it allows for us to address the complexity of producing product in 2021 and into 2022. It reinforces the business model of selling on features (not price) while owning, controlling, and doing more manufacturing lightens the load of the heavy ball that typically comes with that complex outsourced supply chain.

Recent Posts

Related Content

- PureOS Crimson Development Report: November 2025

- PureOS Crimson Development Report: October 2025

- Consent On Everything?

- 60 Minutes Uncovers Hacks on America’s Infrastructure

- Code is Power!